MULTICURRENCY CARD FILLS A NEED IN THE GLOBAL MARKET

Issuers incur several costs associated with foreign transactions:

- Routing transactions across borders.

- Accessing FX markets or pay a broker/dealer to cross the bid/ask spread.

- Warehousing the FX risk for the period between transaction posting until batching, netting, and clearing FX position.

- Incremental fraud liability associated with travel.

To avoid these costs, issuers often open multiple accounts in various foreign currencies — either using pre-paid debit cards or multiple DDA debit cards. Both methods have significant drawbacks to issuer and consumer.

Pre-Paid Card Drawbacks

- Percentage fee associated with reloading

- One-time fee for card

- Non-interest bearing account

- Not a DDA for issuer – limited cross sell

Multiple DDA Debit Card Drawbacks

- Must ship multiple cards internationally

- Multiple cards lead to higher lost/stolen and fraud rates

- Hard for customer to manage, inconvenient

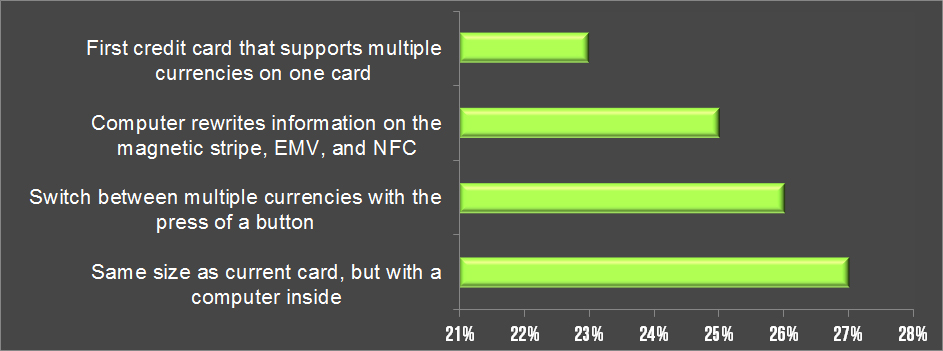

Multi-Currency Card provides streamlined way for the international traveler to carry a single card across borders without exposure to exorbitant fees, undue risk, confusion, and inconvenience.